MSI Mime Type

What is the name for the MIME Type for MSI Files?

I searched for it on multiple web search engines. I thought this would be an easy answer. Instead, I found multiple conflicting sources of what a MSI file MIME type is supposed to be. For those who do not know what a MSI file is, it is a Microsoft installer file, which installs windows applications.

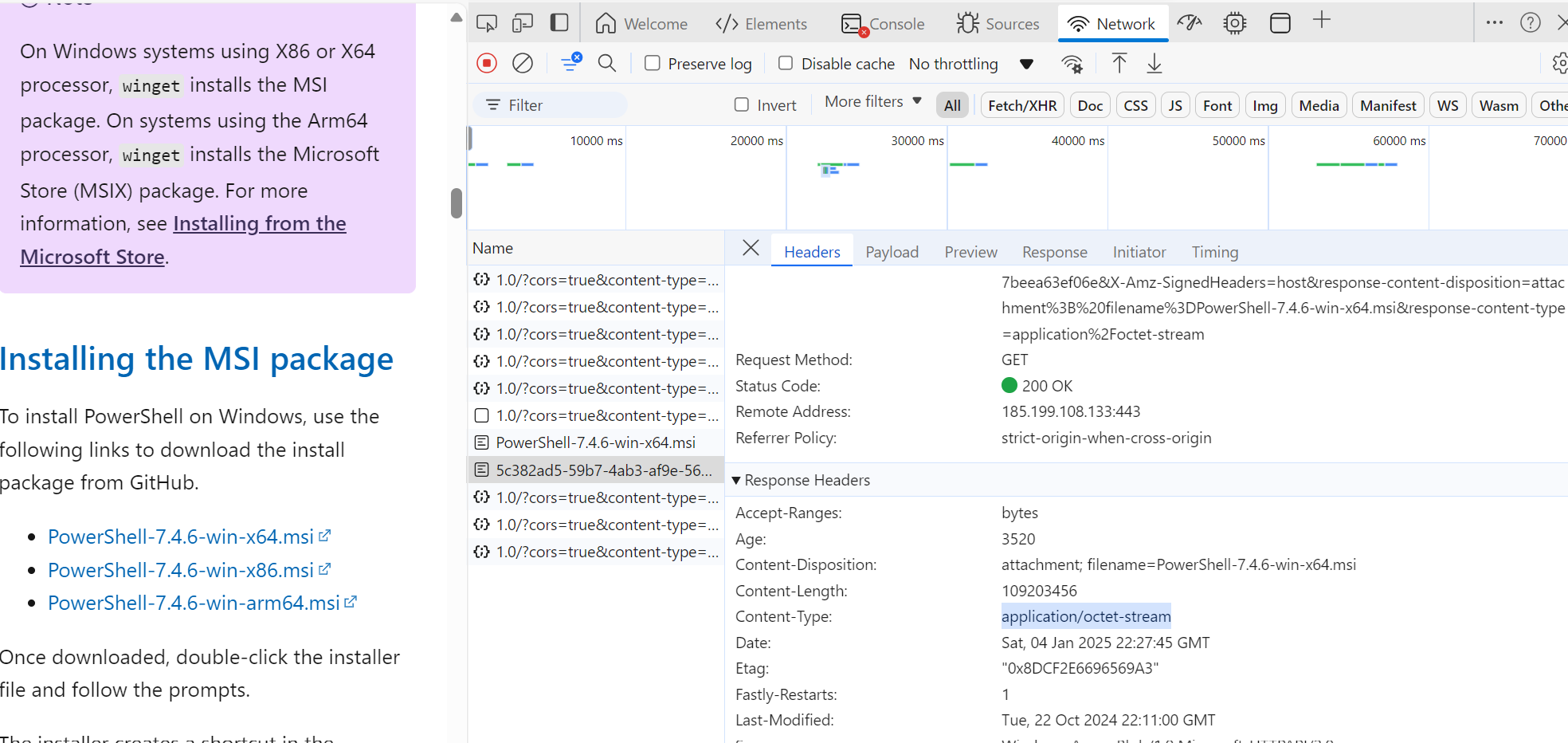

With all the inconsistent search results and without having to rely on the AI output, the only way to settle this answer was to see what Microsoft’s application type is on their MS installers MIME types. I downloaded PowerShell MSI file, but before I did, pressed CTRL+SHIFT+I to inspect the network, viewed the response headers, and discovered that Micrsoft uses the application type of application/octet-stream for their MSI files.